does kansas have inheritance tax

The scam usually begins with an email or letter telling the person that they are a. An inheritance scam is a specific type of scam that uses the tale of a person who is now deceased and has left their estate to the intended victim of the scam.

Does Kansas Charge An Inheritance Tax

The federal estate tax is collected on the transfer of a persons assets to heirs and beneficiaries after death.

. The total tax due is calculated by adding up the fair market values of all the decedents assets as of his date of death although the executor or administrator of the estate can elect to have everything valued on an alternate date.

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Kansas And Missouri Estate Planning Inheritance Tax

Retiring In These States Will Cost You More Money Vision Retirement

State Estate And Inheritance Taxes Itep

State Death Tax Is A Killer The Heritage Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kansas Estate Tax Everything You Need To Know Smartasset

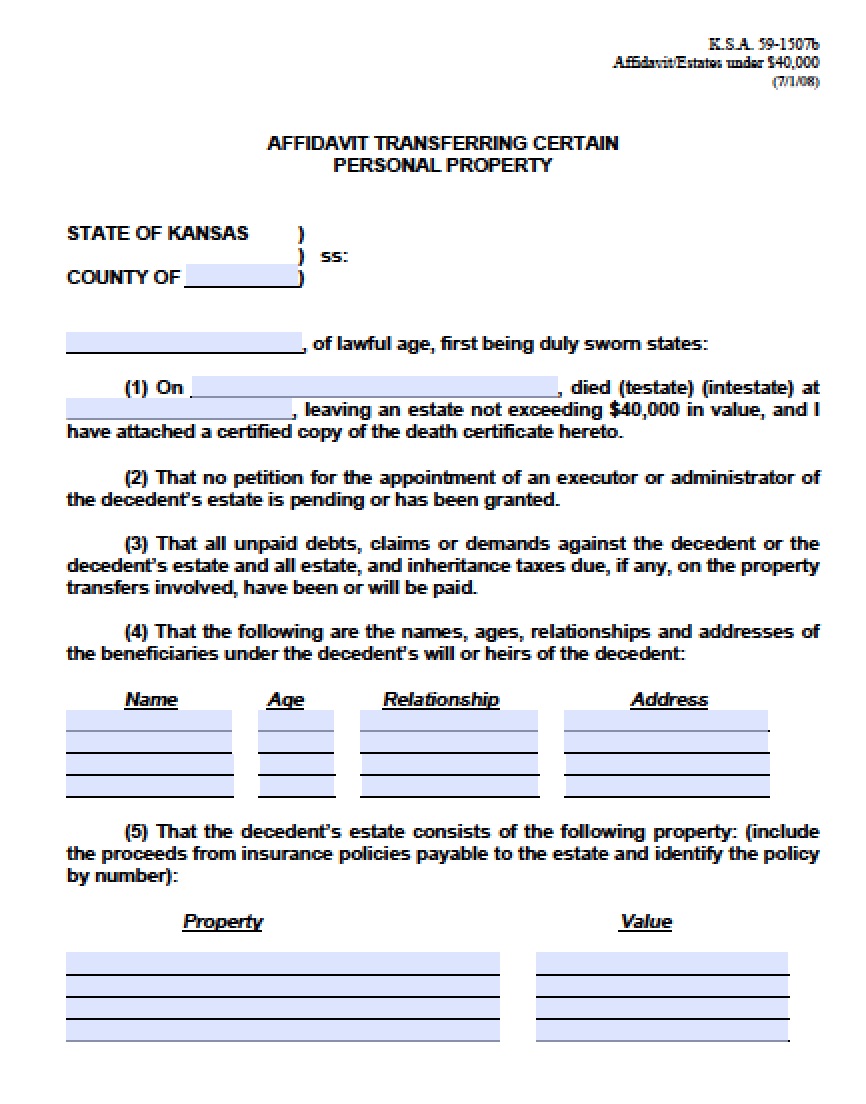

Estate Tax And Inheritance Tax In Kansas Estate Planning

Here S Which States Collect Zero Estate Or Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Tax And Inheritance Tax In Kansas Estate Planning

Kansas Estate Tax Everything You Need To Know Smartasset

Does Kansas Have Inheritance Tax Iae News Site

States With No Estate Tax Or Inheritance Tax Plan Where You Die